June 26, 2023

Are you ready to take the plunge into a sustainable future? With solar financing rates now unveiled, there's never been a better time to make the switch! Solar energy is an affordable, clean, and renewable resource that can help reduce your carbon footprint while saving money.

Now you have access to competitive financing options that make it easy and cost-effective to invest in solar power. So don't wait any longer - discover how solar financing rates can provide you with a roadmap for a brighter, more sustainable future!

What is solar financing?

Solar financing is a way to pay for solar panels and associated equipment without having to pay the full cost upfront. It allows you to spread out the payments over a set period of time, allowing you to invest in solar energy with little or no money down.

There are several types of solar financing rates available to homeowners and businesses interested in installing solar panels.

Types of solar financing rates

Solar financing can come in many forms, such as loans, leases, power purchase agreements, property-assessed clean energy (PACE), etc.

Solar Loans

A solar loan is a type of financing where the borrower takes out a loan to pay for the solar panel installation. The loan is then paid back over time, typically with interest.

Solar Lease

A solar lease is a type of financing where the borrower leases the solar panels from the installer. The borrower pays a monthly fee for the use of the panels, which is typically less than the cost of their previous electricity bill.

Power Purchase Agreement (PPA)

A PPA is a type of solar panel financing where the borrower agrees to purchase the electricity generated by the solar panels at a fixed rate per kilowatt-hour. The borrower does not own the panels, but they benefit from the savings on their electricity bill.

Property Assessed Clean Energy (PACE) Financing

PACE financing is a type of financing where the borrower takes out a loan to pay for the solar panel installation. The loan is then paid back through property taxes over a period of 10-20 years.

Cash Purchase

A cash purchase is a type of financing where the borrower pays for the solar panel installation upfront in cash. This is typically the most cost-effective option, as the borrower does not have to pay any interest on a loan.

Overview of current solar financing rates in the US as of 2023

In the United States, there are solar renewable energy credits that are various options for solar financing that allow homeowners and businesses to reduce their upfront cost of installing solar panels and other equipment. As of 2023, the currently available rates for solar financing are as follows:

- Solar Loan payments typically come with fixed interest rates ranging from 5-20 years. The loan is repaid gradually over time and it allows the user to invest in solar energy with little or no money down.

- Leases are popular options that require no up-front costs. Instead, users pay a fixed monthly rate based on the amount of electricity they generate from the system.

- Power purchase agreements (PPAs) involve users purchasing the electricity generated by their solar panel system at a predetermined rate. They may also be able to take advantage of certain incentives that could potentially reduce upfront costs even further.

- Property Assessed Clean Energy (PACE) financing combines federal solar tax credit, assessment, and financing into one package, allowing homeowners to finance renewable energy systems through their local government. This option is often used when there is not enough capital available to cover all of the costs associated with solar panel installation and operation.

Overall, these solar financing options enable more people to go green without worrying about cost overruns or financial burdens. Additionally, many states offer special incentives such as tax credits and rebates that can help offset some of these costs even more.

It is important to do your research before making an investment in order to ensure that you get the best deal possible!

Comparison of rates for different types of financing

There are several different types of solar financing options available, each with its own set of advantages and disadvantages.

The cost of financing a solar installation can vary depending on the type of financing you choose, the lender or company, and your creditworthiness.

It's important to do your research and compare rates from multiple lenders or companies to find the most affordable option for your needs. Here is a comparison of the rates for some of the most common types of solar financing:

Cash Purchase

The cheapest way to finance a solar installation is to pay for it in cash upfront. While this may require a large initial investment, it can provide the greatest long-term savings since you won't be paying any interest.

Additionally, you may be eligible for government incentives and tax credits that can help offset the cost.

Solar Loan

Solar loans are a popular financing option that allows homeowners to pay for their solar installation over time with monthly payments. Rates for both secured and unsecured solar loans vary depending on the lender, credit unions, loan term, and borrower's creditworthiness.

Generally, interest rates for solar panel loans can range from 2.99% to 8.99% depending on solar loan interest rates, the lender, and the borrower's creditworthiness.

Some solar companies also offer financing through third-party lenders. These loans can be similar to home improvement loans — unsecured with no down payment required.

Home Equity Loans

Another option for financing a solar installation is to take out a home equity loan. This type of solar panel loan allows homeowners to borrow against the equity they have built up in their homes.

Interest rates for home equity loans can range from 3% to 8%, depending on the borrower's creditworthiness and the lender.

Power Purchase Agreements (PPAs)

PPAs are a type of solar financing where a third-party company installs the solar system on the homeowner's property and sells the electricity generated by the system back to the homeowner at a fixed rate.

This option may not require any upfront costs, but the rates for PPAs can be higher than other financing options, generally ranging from 6 cents to 12 cents per kilowatt-hour.

Leases

Solar leases are similar to PPAs in that a third-party company installs and own the solar system on the homeowner's property.

However, with a lease, the homeowner pays a fixed monthly fee to use the solar system. Interest rates for solar leases can vary depending on the company and the terms of the lease, but they can range from 2.99% to 7.99%.

Factors Affecting Solar Financing Rates

Solar financing rates can be affected by several factors, including the minimum credit score and credit history, loan term and down payment, and government incentives and tax credits.

Importance of credit score and credit history

Solar financing companies typically consider a borrower's credit score and credit history when determining the interest rate for a solar loan. Borrowers with higher credit scores and a history of on-time payments are generally considered lower risk and may qualify for lower interest rates.

On the other hand, borrowers with lower credit scores and a history of late payments or defaults may be considered higher risk and may be offered higher interest rates.

Role of the Loan Term and down payment in determining rates

The loan term and down payment can also impact solar financing rates. Longer loan terms may result in higher interest rates, as the borrower is borrowing the money for a longer period of time.

Conversely, a larger down payment may result in lower interest rates, as the borrower is putting more money towards the purchase of the solar system upfront.

However, if you don't have enough equity in your home (or aren't in a place to risk it), an unsecured loan may be the wiser decision.

Impact of government incentives and tax credits

Impact of government incentives and tax credits: The availability of government incentives and federal tax credits can also impact solar financing rates.

Incentives such as the federal investment tax credit (ITC) can help lower the cost of a solar system, which can make financing more affordable.

Additionally, some solar financing companies may offer lower interest rates or other incentives to borrowers who take advantage of these government programs.

Strategies for Securing Affordable Solar Financing Rates

Securing affordable solar financing rates can help make a solar installation more affordable. By considering these strategies, you may be able to secure more affordable financing for your solar installation and enjoy the benefits of renewable energy while saving money over the long term.

Improve your credit score and credit history

Borrowers with higher credit scores and a history of on-time payments are generally considered lower risk and may qualify for lower interest rates.

To improve your credit score, make sure to pay all of your bills on time, keep your credit card balances low, and avoid opening new credit accounts unless necessary. You can also check your credit report for errors and dispute any inaccuracies.

Consider loan term and down payment options

A longer loan term may result in a lower monthly payment, but it may also result in a higher overall cost due to interest. Consider whether you can afford larger monthly payments, as this can help lower your interest rate and reduce your overall loan balance.

Additionally, some solar financing companies may offer lower interest rates for shorter loan terms or larger down payments.

Explore government incentives and tax credits:

The federal government offers a 22% investment tax credit (ITC) for residential solar installations through 2023, which can help reduce the overall cost of a solar system.

Some states and localities may also offer additional incentives, such as rebates or tax credits. For instance, the Educational Employees Credit Union has a solar loan with no loan fees and a 4.49% APR.

Be sure to research incentives and federal tax credit available in your area and factor these savings into your financing plan.

Shop around for financing options

Different lenders may offer different rates and terms for solar loans. It's important to shop around and compare offers from multiple lenders to find the most affordable option for your needs.

Some solar lenders or companies may also offer to finance solar directly, which can simplify the process and potentially offer more competitive rates.

Key Takeaways You Must Remember:

If you are considering going solar, it's important to understand the current solar financing rates and options available to you. Here are a few key takeaways from our blog post:

- Solar financing rates vary depending on the type of financing you choose. Options include cash purchases, solar loans, solar leases, and power purchase agreements (PPAs).

- Cash purchases offer the best long-term savings, but require a significant upfront investment. Solar loans, on the other hand, allow you to spread out the cost over time and typically offer lower interest rates than credit cards.

- Solar leases and PPAs allow you to go solar with little to no money down but typically come with higher overall costs than other financing options.

- Before deciding on a financing option, be sure to research the available incentives and tax credits in your area. These can significantly reduce the overall cost of going solar.

- It's important to choose a reputable solar installer with experience in your area. They can help guide you through the financing process and ensure you're getting the best deal possible.

Final thoughts:

Step into the radiant realm of solar financing and unlock the gateway to a sustainable future! Our solar financing rates reveal a thrilling path to reduced energy costs and environmental harmony. Brace yourself for the captivating choices that lie ahead: the courageous Cash Crusaders, the resilient Loan Legends, the adventurous Leasing Mavericks, and the empowered Power Purchase Avengers.

Amidst this captivating landscape, discover the hidden treasures of government incentives and tax credits. Embrace the guidance of a trusted solar ally as you embark on this transformative journey. The time has come to illuminate your world with renewable energy and embark on a captivating adventure toward a greener horizon!

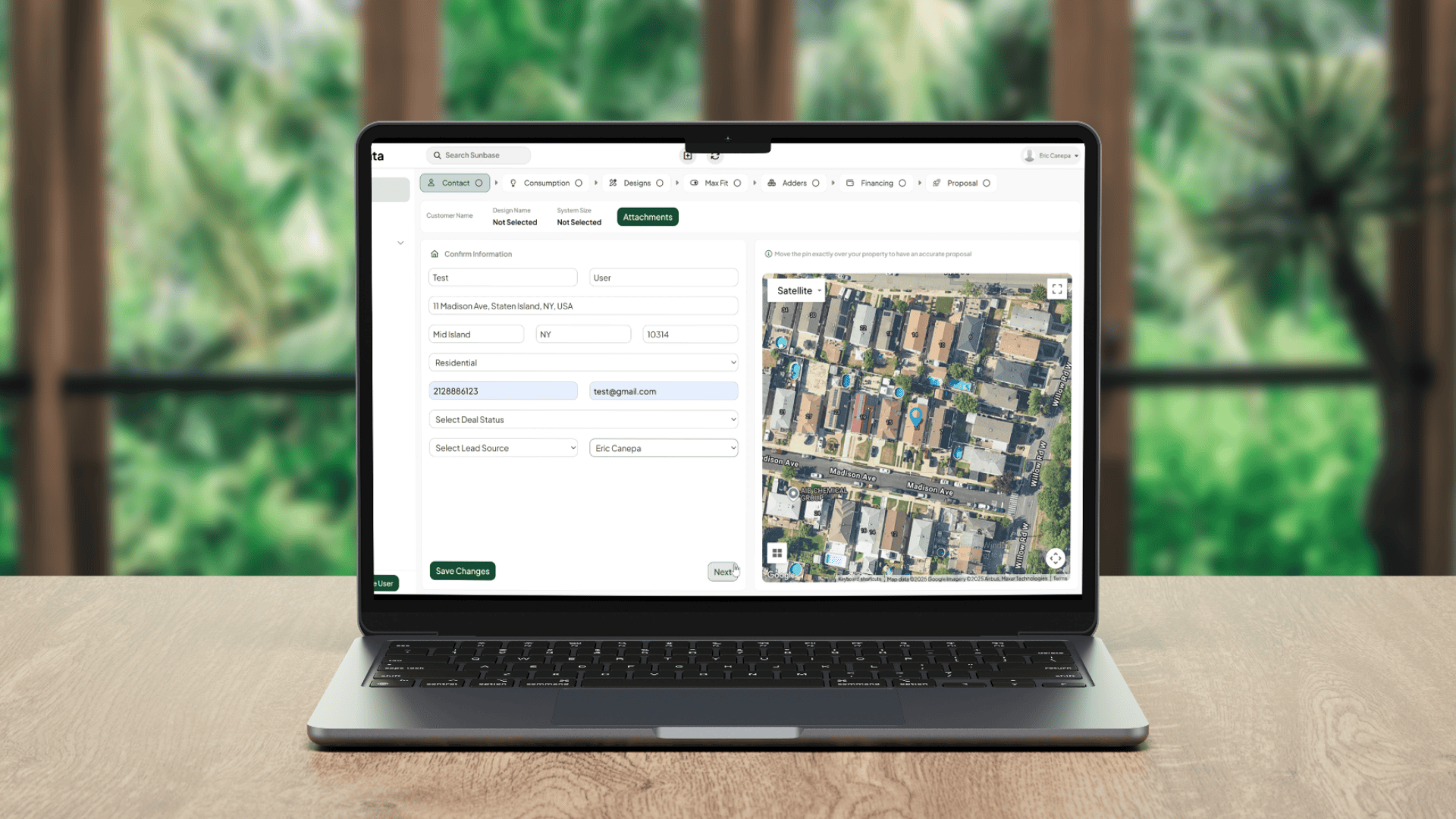

One Platform. Zero Chaos. Run Your Entire Business in One Place.

Sunbase replaces your CRM, proposals, scheduling, job tracking, and reporting tools — all inside one clean, connected platform.

About Sunbase

The All-In-One Platform to Run Your Entire Business

Sunbase helps you organize operations, streamline daily workflows, and manage everything - from first customer contact to final project deliver- in one connected system.

Our Mission

- Organize your business.

- Optimize your workflow.

- Automate what slows you down.

Why Businesses Choose Sunbase

One Connected Workflow

Replace scattered tools and manual processes with a single platform that brings together your team, tasks, customers, jobs, and performance data.

🌎 Global Presence

Serving the United States, Canada, India, LATAM, Australia, and 10+ international markets.

👥 11,000+ Users

Trusted by contractors, installers, project managers, sales teams, and field technicians.

🏗️ Built for All Sizes

From small contracting teams to fast-growing enterprises, Sunbase adapts to your workflow.

Useful Links For You

Stop Managing Your Business Manually. Automate It.

Sunbase automates workflows, reduces mistakes, and helps your team get more done - without hiring extra staff or juggling multiple tools.