November 16, 2022

What is payroll software and how does it work?

Payroll software is a computer program that automates the process of calculating and issuing paychecks.

It typically interfaces with a company's accounting software to ensure that all the necessary tax withholdings and deductions are made. Most payroll software also allows employers to track employee hours and benefits.

Types of payroll system

A payroll system is a program used by businesses to pay employees. The system calculates how much each employee should be paid based on hours worked, and then generates paychecks or direct deposit payments accordingly.

Payroll systems can be either manual or electronic. Manual payroll systems involve keeping paper records of employee hours worked and then doing the math by hand to calculate wages. Electronic payroll systems use time clock software to electronically track employee hours, and then the wages are calculated automatically.

There are several different types of payroll systems available, and the best one for your business will depend on factors like the size of your company, your budget, and your needs.

Here is a closer look at some of the most popular types of payroll systems:

Outsourced Payroll Services

Outsourced payroll services mean that you are hiring a third-party company to handle all aspects of your payroll for you.

This type of service is ideal for small businesses that don't have the internal resources to handle payroll themselves. When you outsource your payroll, you can rest assured that it will be handled correctly and on time every single week or month.

The downside of outsourced payroll is that it can be costly, and you will have less control over the process than if you handle it in-house.

In-House Payroll Software

In-house payroll software means that you will handle all aspects of your payroll internally using specialized software.

This type of solution is ideal for medium to large businesses that have the internal resources to handle payroll themselves but don't want to do it entirely manually.

In-house payroll software can be expensive upfront, but it will save you money in the long run because you won't have to pay for outsourced services.

Full-Service Payroll Provider

A full-service payroll provider is similar to an outsourced service, but with one key difference: with a full-service provider, you'll use their software instead of your own.

This type of solution is ideal for businesses of all sizes who want the convenience of outsourcing but don't want to give up control of their data.

Full-service providers usually charge a monthly fee plus a per-employee fee, so it can be expensive if you have a large workforce.

Hybrid Payroll System

A hybrid payroll system is a combination of an in-house system and an outsourced service. With this type of system, you'll use software to track employee hours and calculate wages internally, but you'll outsource the actual processing and payment part of payroll to a third party.

This type of solution is ideal for businesses that want more control than what an outsourced service offers but don't want to deal with processing payments themselves.

The downside of a hybrid system is that it can be more expensive than either an in-house or outsourced solution because you're paying for both services.

What are the benefits of using payroll software?

There are a number of different ways to manage payroll, but one of the most efficient is by using payroll software. In this blog post, we'll outline all the benefits your business will gain from using payroll software. After reading this post, you'll see why payroll software is a worthwhile investment for any business.

Increased Efficiency

Using a contractor payroll software will help increase the efficiency of your payroll process. When you use software to manage payroll, you can automate many of the tasks that are required to process payroll manually.

This includes things like calculating the employees and contractors hours worked, calculating federal and state taxes, and generating pay stubs. Automating these tasks will free up your time so you can focus on other areas of your business.

Reduced Errors

Another benefit of using payroll software is that it can help reduce errors. When you enter data into a computer system, there's always a risk of human error.

But when you use software to manage payroll, many of the calculations are done automatically. This means there's less room for error and your employees will get paid the correct amount of money each pay period.

Improved Security

Payroll software can also help improve the security of your payroll process and paying employees. When you use paper records to manage payroll, there's always a risk that those records could be lost or stolen.

But when you use software to manage payroll, your employee information is stored securely in the cloud. This means that only authorized users will be able to access it—and if anything does happen to your computer system, you'll be able to easily retrieve your employee information from backups.

Accurate Calculations

One of the biggest benefits of using payroll software is that it takes the guesswork out of calculating employee paychecks. With payroll software, you can be confident that your employees will always be paid correctly.

This is because payroll software uses a complex algorithm to calculate employee wages, taking into account factors such as hours worked, overtime, vacation days, and sick days. This ensures that your employees are always paid correctly and on time.

Time Savings

Another big benefit of using payroll software is that it can save your business a significant amount of time. manually calculating paychecks can be extremely time-consuming, especially if you have a large number of employees.

By using payroll software, you can automate the entire process and free up your HR team to focus on more important tasks. In addition, because payroll software is so accurate, it can also help to reduce the number of errors in your paycheck calculations, further saving you time in the long run.

Cost Savings

In addition to saving you time, using payroll software can also save you money. First, by automating the process of calculating paychecks, you can reduce the amount of time your HR team spends on payroll each week.

This can lead to reduced labor costs for your business. In addition, by using payroll software, you can avoid costly mistakes in your paycheck calculations, as a part of employee benefits.

Finally, many payroll software providers offer discounts for businesses that sign up for annual or multi-year contracts. This can further reduce the cost of using payroll software for your business.

These are just a few of the benefits that your business will gain from using payroll software. If you're looking for a way to increase the efficiency and security of your payroll process, then investing in payroll software is a no-brainer.

Not sure which payroll software is right for your business? Check out Sunbase Finance and Payroll Software or contact Sunbase team today to find the perfect solution for your needs.

How to choose the right payroll software for your business?

What to Consider When Choosing Payroll Software?

There are a few key things you'll want to keep in mind when choosing payroll software for your business.

First, you'll want to think about the size of your company and how many employees you have. You'll also want to consider the frequency of pay periods and whether you want to offer direct deposit.

Additionally, you'll want to take into account any special features or functionality that you may need, such as the ability to track vacation days or sick days. Keep all of these factors in mind when narrowing down your choices.

What Are the Top Payroll Software Options?

Once you know what factors are important to you, it's time to start looking at some of the top payroll software options. A few popular choices include ADP, Gusto, and QuickBooks.

Each option has its own unique set of features, so be sure to compare them side-by-side to see which one has everything you need. Once you've made your decision, it's time to get started using your new payroll software!

Choosing the right payroll software be it for payroll tax filings or payroll taxes by pay contractors or independent contractors for your business can be a daunting task. With so many options on the market, it's hard to know where to start.

Do you need something that is full-featured with all the bells and whistles? Or would a simpler solution suffice?

Here are four factors to consider when choosing payroll software for your business-

Ease of Use

One of the most important factors to consider when choosing payroll software is ease of use. You want something that is intuitive and easy to navigate. The last thing you want is something that is so complicated that it takes hours to figure out how to use it.

Compatibility

You'll also want to make sure that the payroll software you choose is compatible with your existing accounting software. This will make things much easier and streamline your accounting process.

Pricing

Of course, pricing is always a consideration when choosing any type of software for your business. But it's especially important when it comes to payroll software since this is an essential function for any business.

You'll want to find something that fits within your budget but also offers all the features and functionality you need.

Support

Finally, you'll want to make sure that the payroll software you choose comes with excellent customer support. This is vital in case you have any questions or run into any problems.

Payroll software is an essential tool for any business.

By taking these factors into account, you can be sure to find the right payroll solution for your business needs.

Features to look for in a good payroll software package

Payroll is one of the most important—and complex—aspects of running a business. It's also one of the most commonly outsourced services. If you're thinking of switching to a payroll service or are simply looking for a new provider, there are a few key features you should keep in mind. In this blog post, we'll go over four must-haves in any good payroll software package.

Automatic Tax Filing

One of the biggest advantages of using a payroll service is that they will handle all of your tax filings for you—including federal, state, and local taxes. This takes a huge burden off of your shoulders and ensures that everything is filed on time and correctly.

Direct Deposit

Another big benefit of using a payroll service is that they can handle direct deposit for your employees. This means that your employees will get paid on time, every time—no more waiting for paper checks to come in the mail.

User-Friendly Interface

The payroll software you choose should be easy to use—both for you and your employees. A user-friendly interface will make it easy for you to input data and run reports, while also allowing your employees to access their pay stubs and W-2 forms with ease.

Robust Reporting

Reporting is an essential part of any payroll system. You should have access to real-time reports so you can see how much money is being paid out in salaries, bonuses, and commissions at any given time. The best payroll software packages will also allow you to generate historical reports so you can track your expenses over time.

When it comes to choosing a payroll software package, there are a few key features you should look for—including automatic tax filing, direct deposit, a user-friendly interface, and robust reporting capabilities.

Keep these factors in mind when shopping around for a new payroll provider, and you're sure to find a system that's just right for your business.

Sunbase HR & payroll software & features

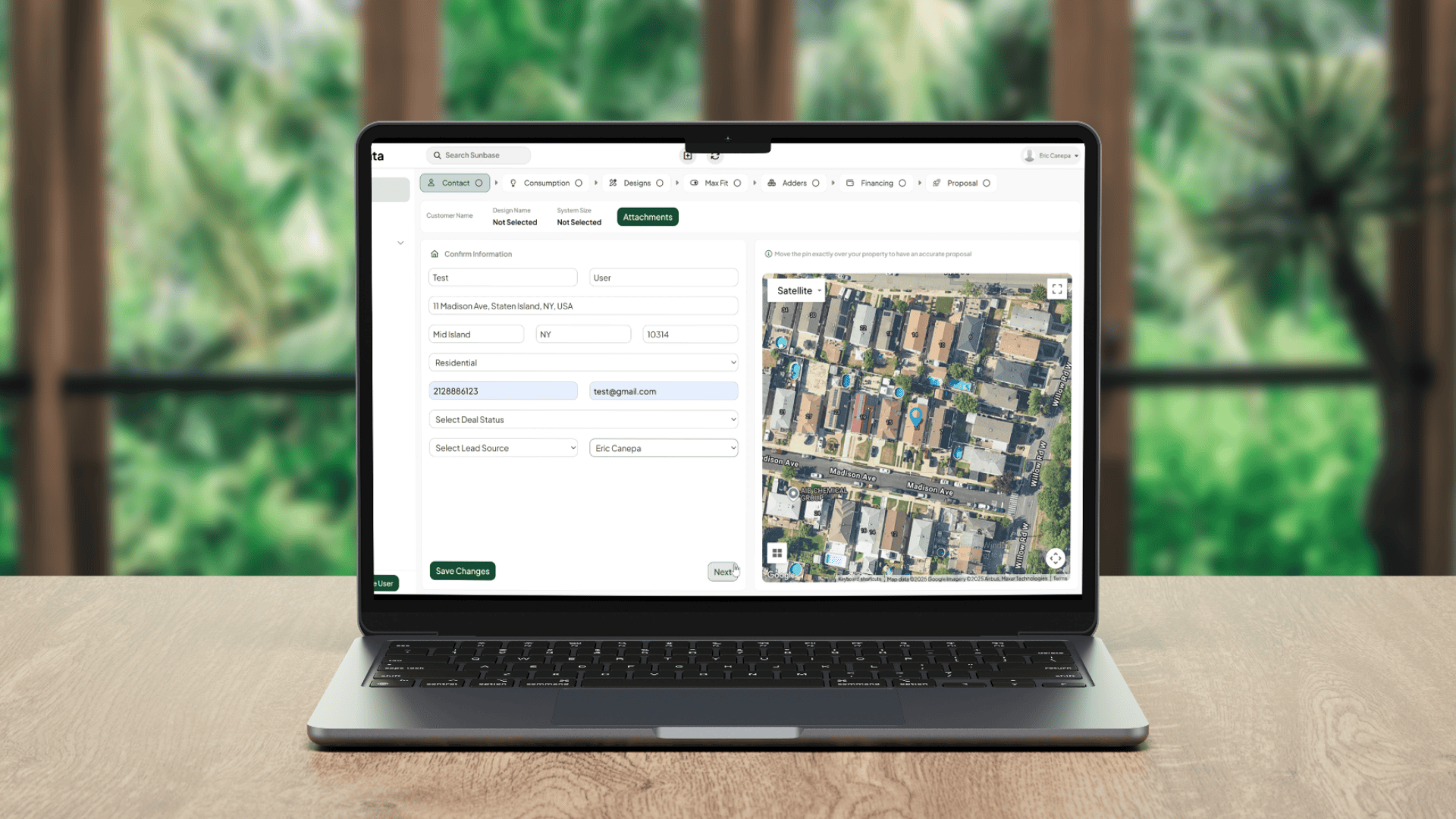

At Sunbase, we understand that running a business is difficult enough without having to worry about payroll and HR tasks. That's why we've developed our all-in-one HR & payroll software solution to make your life easier.

With Sunbase HR Management Software, you can manage your employee data, process payroll, and access powerful reporting features, all in one place. Keep reading to learn more about what Sunbase can do for you.

Features of Sunbase HR Management Software-

Powerful Reporting Capabilities

One of the most powerful features of Sunbase is our reporting capabilities. With just a few clicks, you can generate detailed reports on everything from employee productivity to payroll costs.

Plus, our reports are highly customizable, so you can get the exact information you need to make informed decisions about your business.

Seamless Payroll Processing

With Sunbase, payroll processing is a breeze. Simply enter your employees' hours worked and our software will do the rest. We'll calculate wages, deduct taxes, and send payments directly to your employees' bank accounts. Sunbase HR and payroll software will also help you manage employee benefits for your salaried employees.

Plus, our innovative direct deposit feature makes it easy for employees to access their earnings as soon as they're available.

Manage Employee Data with Ease

Sunbase makes it easy to store and manage all of your employee data in one place. From contact information to performance reviews, you'll have everything you need at your fingertips to make running your business a breeze.

Plus, our software is highly secure, so you can rest assured that your employee data is safe and confidential.

User-Friendly Interface

Our software is designed with user-friendliness in mind. We understand that not everyone is a tech expert, which is why we've made our interface easy to navigate and use.

Whether you're accessing Sunbase for the first time or you're a seasoned pro, you'll be able to find what you're looking for quickly and easily in this cutting-edge contractor payroll software.

Conclusion

If you're looking for an all-in-one HR & contractor payroll solution that is easy to use and packed with features, look no further than Sunbase. With our powerful reporting capabilities, seamless payroll processing, and user-friendly interface, Sunbase has everything you need to take your business to the next level.

I agree to receive marketing messaging from Sunbase at the phone number provided above. I understand data rates will apply, and can reply STOP to OPT OUT.