June 16, 2022

What is Commercial Solar Financing?

Commercial solar financing is a type of investment that allows businesses to finance the purchase and installation of solar panels.

Commercial solar financing tools can be used to offset the upfront cost of solar panel installation and provide businesses with a return on their investment through the sale of renewable energy credits (RECs) or other incentives. Commercial solar financing can also be used to hedge against future energy price increases.

Types of Commercial Solar Financing

There are a few different commercial solar financing options, including:

Solar leasing:

This is when a business leases solar panels for commercial projects from a solar company or third-party financer. The solar company owns, operates, and maintains the system, while the business agrees to pay for the electricity produced by the system. A solar lease typically has a term of 10-20 years.

Solar leases are another financing option for businesses. With a solar lease, you make monthly payments to the leasing company for the use of the solar panels. The leasing company owns and maintains the panels, so there's no upfront cost for you. Solar leases typically have a term of 15 years, and at the end of the lease, you have the option to purchase the panels for a reduced price or renew the lease.

This can help offset the cost of your electric bill and save money on energy costs over time. However, you'll need to have good credit in order to qualify for a PPA.

Solar power purchase agreements (PPAs):

This is when a business agrees to purchase solar systems from a solar company or third-party financer at a fixed rate over some time, usually 10-20 years. The solar company owns, operates, and maintains the system.

Solar PPAs are a popular option for businesses because they offer a way to go solar with no upfront costs. With a PPA, you agree to purchase the power generated by the solar panels at a fixed price over a period of time, typically 20 years.

Solar loans:

This is when a business takes out a loan to finance the purchase of solar panels. The business owns the system and is responsible for its maintenance. Solar loans typically have a term of 5-15 years.

Solar loans are another financing option for businesses. With a loan, you finance the purchase of the solar panels and pay back the loan over time, typically over a period of five to 20 years. Loans can be a good option if you have equity in your business or good credit. However, they do require that you have some upfront capital in order to finance the purchase of the solar panels.

Commercial solar projects can be an excellent way for businesses to save money on their energy costs and help the environment by offsetting their emissions. Solar financing can also provide businesses with a hedge against future energy price increases.

If you are a business owner considering solar installations, be sure to speak with a solar financing expert to find out what option may be best for you. Commercial solar financing is a great way to invest in renewable energy and save money on energy costs.

Benefits of commercial solar financing

Financing your commercial solar panels is a great way to save money on your monthly energy bills and reduce your carbon footprint. There are many benefits to investing in your solar panels, including the following:

- Commercial solar financing companies can help you save money on your monthly energy bills.

- Commercial solar financing can help you reduce your carbon footprint.

- Commercial solar financing can help you increase the value of your property.

- Commercial solar financing can help you take advantage of government incentives.

- Commercial solar financing can help you protect yourself against rising energy costs.

Commercial solar financing can help you get the funding you need to make your solar project a reality. Talk to a solar financing specialist today to learn more about your options.

What to consider while choosing a commercial solar energy financing provider?

A few key things to consider when choosing a commercial solar finance provider. Here are some of the most important factors to keep in mind:

1. The interest rate:

This is perhaps the most crucial factor when choosing a finance provider. Compare rates between different providers to ensure you're getting the best deal possible.

2. The term length:

Another critical factor to consider is the length of the loan terms. Some providers may offer a shorter duration, while others may extend the loan over a longer period of time. Choose the option that best suits your needs and financial situation.

3. The repayment schedule:

You'll also want to consider how you'll be required to repay the loan. Some providers may offer flexible repayment plans, while others may require a more rigid schedule. Again, choose the option that best suits your needs and financial situation.

4. The fees and charges:

Be sure to read the fine print and understand the fees associated with the loan. Some providers may charge origination fees, prepayment penalties, or other hidden charges.

5. The customer service:

Be sure to consider the quality of customer service offered by the finance provider. You'll want to choose a provider that is easy to communicate with and responsive to your needs.

6. Sustainable capital finance

Sustainable capital finance is financing that helps organizations or individuals invest in environmentally friendly projects. Sustainable capital finance can take many forms, such as loans, grants, or investments. Sustainable capital finance is often used to fund renewable energy projects

7. The Investment Tax Credit (ITC) :

The Investment Tax Credit (ITC) is a federal tax credit allowing businesses to deduct a portion of the installation cost of solar panels. The ITC was created in 1976 to encourage companies to invest in renewable energy.

8. Commercial solar loan :

Commercial solar loans are becoming increasingly popular to finance the purchase and installation of solar panels for businesses and other commercial properties. Several different lenders offer these types of loans, so it's important to compare options to find the best deal.

9. Solar contractors :

Solar contractors are a great way to finance your commercial solar project. Solar contractors have the experience and expertise to help you get the most out of your investment. Solar contractors can also provide financing for your project so you can get started on your solar project sooner. Solar contractors are a great way to make sure your commercial solar project is a success.

10. Experience :

You will want to make sure that the provider has experience with solar financing. This way, you can be confident that they understand the unique needs of your project and can provide the best possible terms.

By keeping these factors in mind, you can be sure to choose the best commercial solar finance provider for your needs.

The Pros and Cons of each type of Commercial Solar Financing

There are a few different types of commercial solar financing, each with its pros and cons. Here is a brief overview of some of the most common options:

1. Solar leases/power purchase agreements (PPAs):

- Pros: No upfront cost, lower monthly payments, predictable energy costs

- Cons: Long-term commitment, the higher overall cost

2. Solar loans:

- Pros: Lowest overall cost, no long-term commitment

- Cons: Higher upfront cost, higher monthly payments

3. Solar rebates and tax incentives:

- Pros: Lower upfront cost, government incentives

- Cons: Limited availability, complex paperwork

4. Solar crowdfunding:

- Pros: Low upfront cost, democratic ownership model

- Cons: Limited availability, higher risk

Which type of commercial solar financing is right for you will ultimately depend on your unique circumstances and needs. Be sure to consult with a qualified solar installer or financial advisor to explore your options and make the best decision for your business.

How to choose the right type of commercial solar financing for your business?

Commercial solar financing can be a great way to save on energy costs for your business. But how do you choose the right type of financing for your business?

There are a few things to consider when selecting commercial solar financings, such as the size of your business, energy needs, and budget.

The size of your business :

Your business will dictate the size of the solar system you need and, therefore, the amount of financing you need.

Your energy needs :

Your energy needs will also play a role in choosing commercial solar financing. If your business uses a lot of energy, you may want to consider a lease or power purchase agreement, which can offer lower energy rates.

Your budget:

Your budget will be a factor in choosing commercial solar energy systems. Many financing options are available, so be sure to shop around and compare rates before making a decision.

Conclusion

While solar financing options abound, business owners should carefully research the best option for their company. Evaluating tax benefits and long-term savings is crucial in making the best decision for commercial solar power.

There are many factors to consider when choosing a financing plan, but businesses that make the switch will enjoy significant financial and environmental benefits. Have you considered switching to commercial solar power? If so, what type of financing are you considering? Let us know in the comments below!

About Sunbase

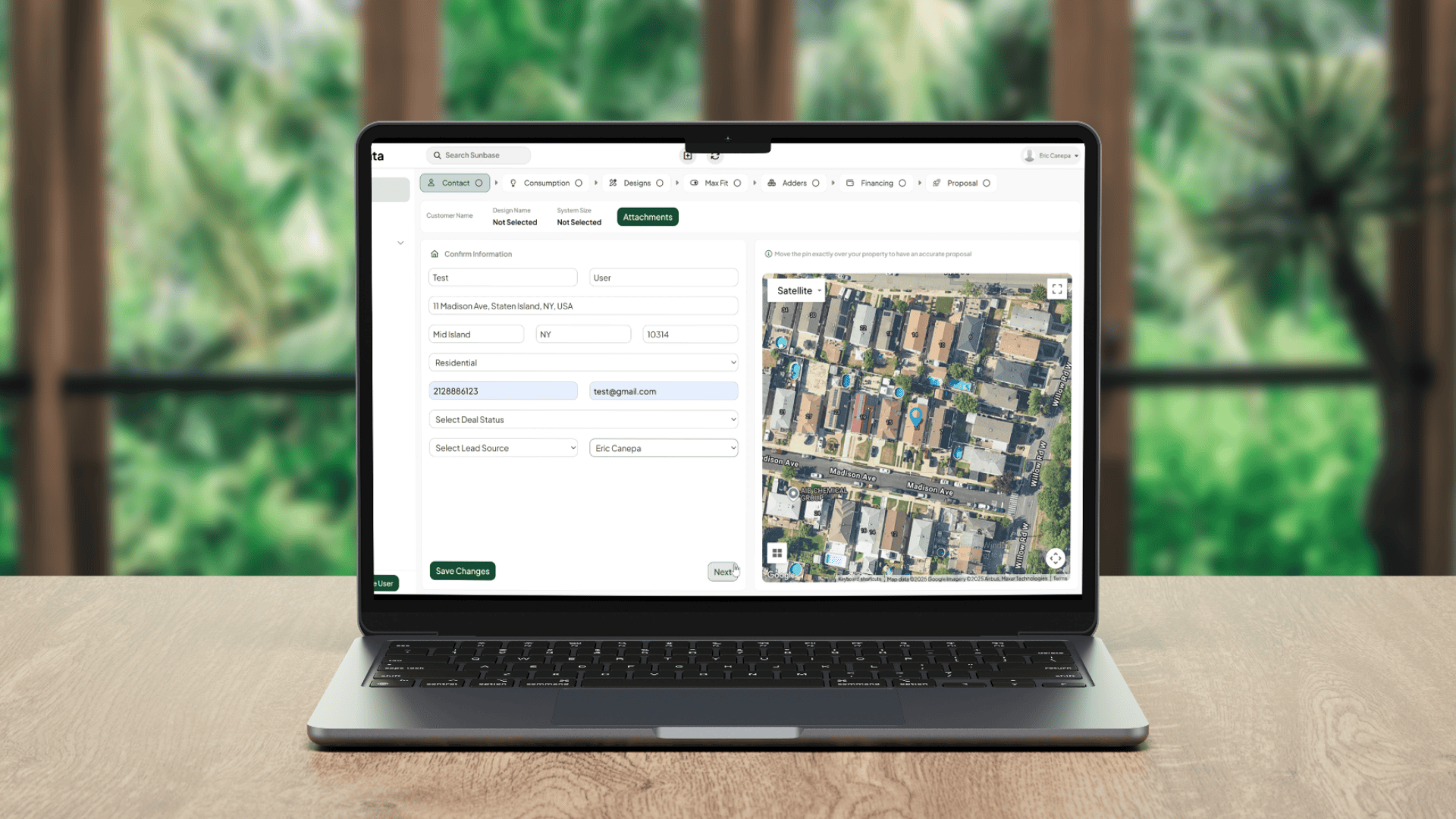

Sunbase helps solar companies succeed through a suite of Solar CRM tools like Solar Lead Management Software, Solar Proposal Software, etc.! To book your free demo or an appointment, contact us here

One Platform. Zero Chaos. Run Your Entire Business in One Place.

Sunbase replaces your CRM, proposals, scheduling, job tracking, and reporting tools — all inside one clean, connected platform.

About Sunbase

The All-In-One Platform to Run Your Entire Business

Sunbase helps you organize operations, streamline daily workflows, and manage everything - from first customer contact to final project deliver- in one connected system.

Our Mission

- Organize your business.

- Optimize your workflow.

- Automate what slows you down.

Why Businesses Choose Sunbase

One Connected Workflow

Replace scattered tools and manual processes with a single platform that brings together your team, tasks, customers, jobs, and performance data.

🌎 Global Presence

Serving the United States, Canada, India, LATAM, Australia, and 10+ international markets.

👥 11,000+ Users

Trusted by contractors, installers, project managers, sales teams, and field technicians.

🏗️ Built for All Sizes

From small contracting teams to fast-growing enterprises, Sunbase adapts to your workflow.

Useful Links For You

Stop Managing Your Business Manually. Automate It.

Sunbase automates workflows, reduces mistakes, and helps your team get more done - without hiring extra staff or juggling multiple tools.